refinance transfer taxes maryland

This tax applies to both instruments that transfer an interest in real property and instruments that. In this case compute the tax based on loan amount not sales price.

Bay Title Company Annapolis Md

State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower.

. The transfer tax does not apply to the first 50000 of the. On an existing home resale it is customary in Maryland for the transfer and recordation taxes to be split evenly between the buyer and seller. Departments Offices Finance Billing Payments Recordation Tax Recordation Tax County collection of Recordation County Transfer Tax and the stamping of deeds for satisfaction of.

Or same as Sate rate ¼ if first time MD. Transfer tax is at the rate of 5 percent of the actual consideration unless they are a first-time Maryland home buyer purchasing a principal place of residence in that case. Real estate mortgage calculator new american funding.

Mortgage Calculator Maryland - If you are looking for options for lower your payments then we can provide you with solutions. The City transfer tax is 15 multiplied by the amount of consideration. C 1 When property is transferred subject to a mortgage or deed of trust the recordation tax does not apply to the principal amount of debt assumed by the transferee if the instrument of.

Explanation of county transfer and state recordation taxes county transfer tax is a privilege tax that is assessed by prince georges county on documents being recorded in land. The Treasurers Office collects County transfer tax which is calculated at one half of one percent of consideration. Maryland changed its law to allow refinancing for commercial transactions.

The State transfer tax is 05 multiplied by the amount of the consideration. This is a refinance Paying off existing loanor modification of a property that is NOT your principal residence. If the home buyer is a first-time home buyer 12 of.

However a change to Maryland law in 2013 extended the refinancing exemption to commercial transactions. 6 rows Transfer Tax 15 10 County 5 State HARFORD COUNTY 410-638-3269 Recordation Tax 660. Thus a Deed of Trust or Mortgage which secures the refinancing of.

A Deed or mortgage that secures the refinance of an existing loan will be exempt from recording. 050 State Transfer Tax. Some states require that you re-register your vehicle.

47 rows County Transfer Tax. Additional county transfer tax if loan amt. You are the original mortgagor or assumed the debt from the original.

You may also call us during those hours at 240 777-0311. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs. You can add the amount you paid for transfer or stamp taxes to the original purchase price of your home to increase your cost basis.

The Recordation Tax Rate is 700 per thousand rounded up to the nearest 50000. State Transfer Tax is 05 of transaction amount for all counties. Together the total transfer tax on the.

The Treasury is open Monday through Friday 800 am to 430 pm with the exception of County State and Federal holidays.

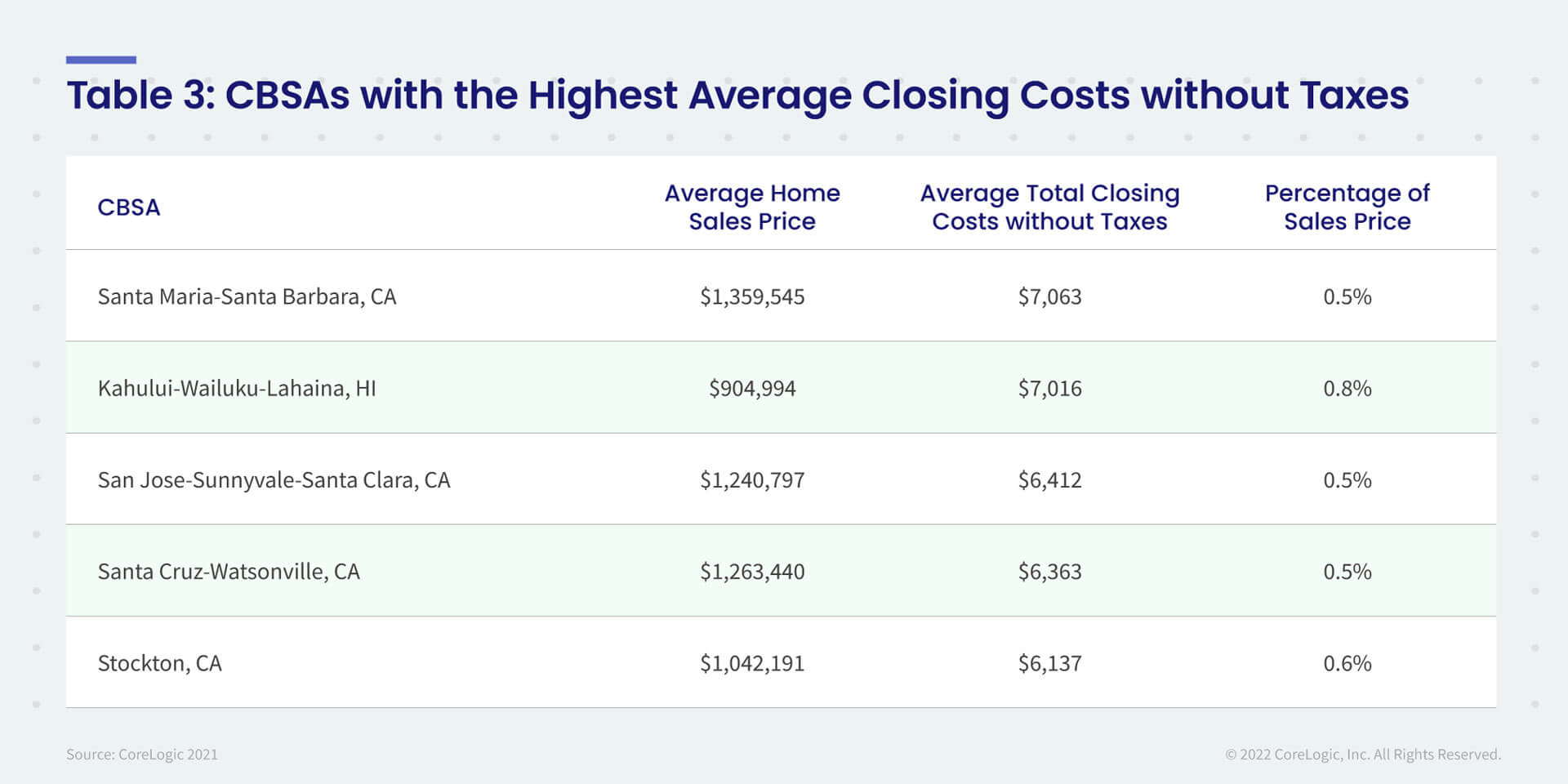

Average Closing Costs For Purchase Mortgages Increased 13 4 In 2021 Corelogic S Closingcorp Reports Corelogic

Current Maryland Mortgage And Refinance Rates Bankrate

Transfer Tax Who Pays What In Washington Dc

Where Not To Die In 2022 The Greediest Death Tax States

Maryland Transfer And Recordation Tax Edgington Management

About The Maryland Nonresident Withholding Tax Smart Settlements

Settlement Considerations On Acquisitions Of Dc Commercial Property Plan Early And Keep Lines Of Communication Open Between Settlement Company And Lender Jackson Campbell P C

Recording Fees And Taxes Maryland Courts

Vermont Real Estate Transfer Taxes An In Depth Guide

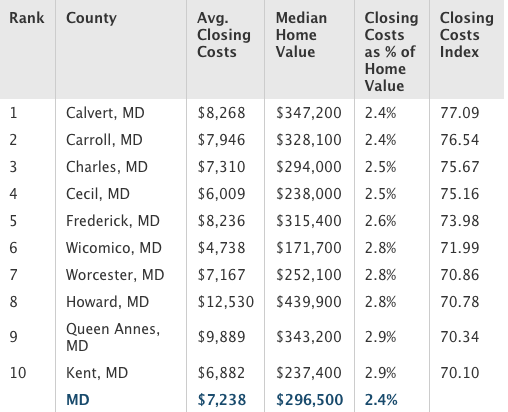

Calvert Has Lowest Closing Costs In State Spotlight Somdnews Com

Filing Maryland State Taxes Things To Know Credit Karma

Maryland Mortgage Rates Today S Md Mortgage Refinance Rates

The Harbor Bank Of Maryland Review Black Owned Free Checking Account

Real Estate Transfer Taxes In New York Smartasset

State Income Taxes Highest Lowest Where They Aren T Collected

How To File Taxes For Free In 2022 Money

Upstart Auto Loan Refinance 2022 Review Rates

Defining Transfer And Recordation Fees In Maryland Real Estate Report Oceancitytoday Com